Apella Wealth Blog

Wars and Markets

The escalation of tensions in the Middle East and the Israeli army’s campaign in Gaza has flared into open conflict between Israel and Iran. Iranian missiles have been raining down on Israel in retaliation for Israel’s bombing of the Iranian embassy in Syria. Iran has said that its response will be measured. Israel says that the missile attack is a declaration of war, even though it appears that most of the attack was intercepted before reaching the intended targets.

This alarming turn of foreign affairs comes on top of Russia’s ongoing invasion of Ukraine (now in its 26th month) which has threatened to spill into Eastern Europe. It’s natural to ask how these turns of events will impact global stock and bond markets and unfortunately, the answers are not clear.

The quick-twitch traders who drive daily price movements in the stock markets are averse to uncertainty, so the easy prediction is that we could see an initial rush to safety (selling stocks and moving to “safer” investments like bonds or cash) that will take the markets lower. In this most recent situation, global stock markets responded with a downturn, with gold and bonds experiencing price increases. In the past, dips like these have been temporary and if there is a standoff or stand-down, then the quick-twitch traders could be the first to rush back into the stock markets, driving share prices on their previous positive trajectory. This is classic market-timing behavior and one can wonder how they expect to make a profit from these short-term efforts to guess the timing, intensity, and impact of global conflict.

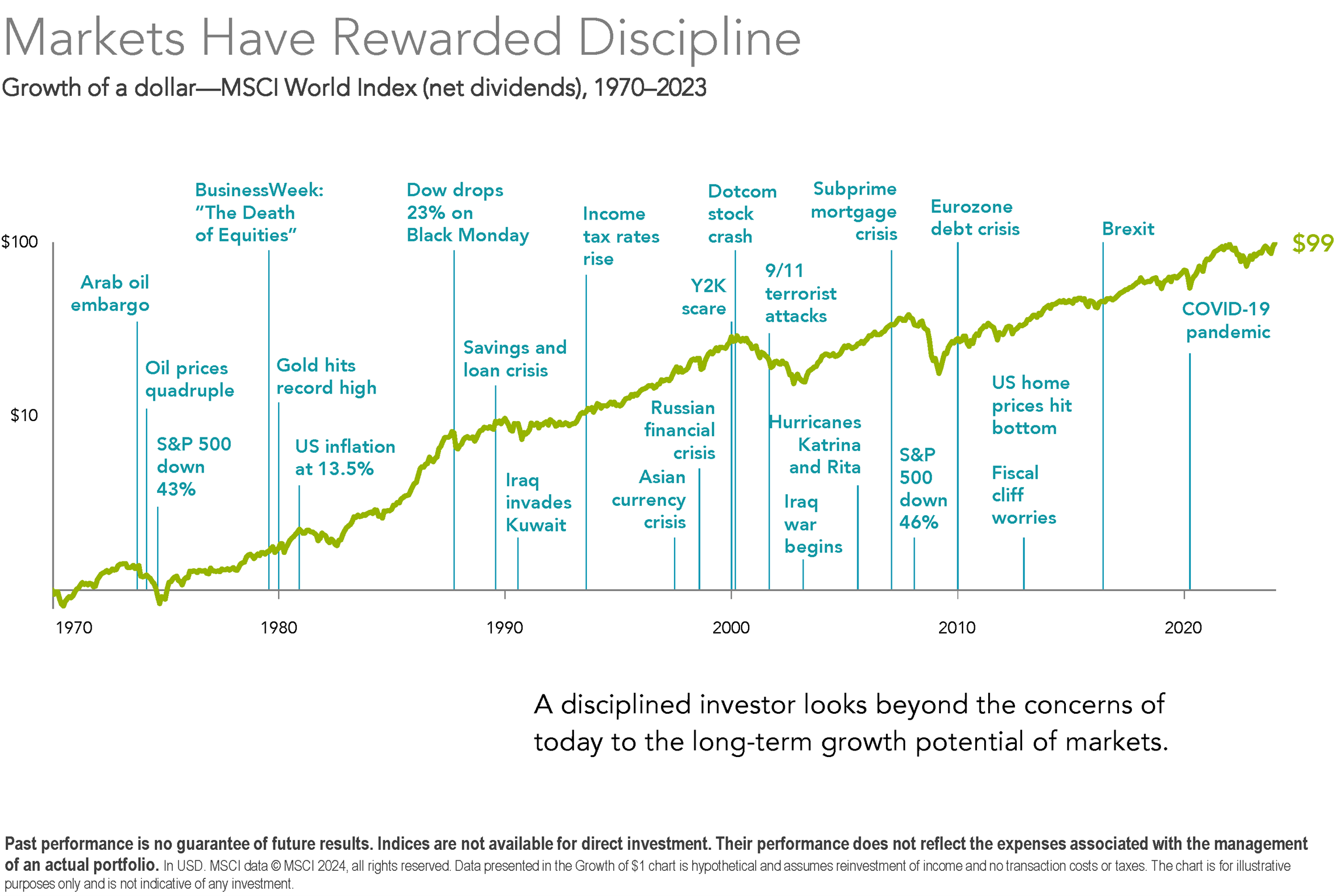

Regardless of their intent, short-term market timing efforts rarely generate the results these investors seek and are even harder to repeat. The good news is that, if the past is any indication, the outcome is somewhat more certain for long-term investors.

The markets, in the past, have risen despite significantly more fearsome events than what we’re experiencing now: the assassination of a president, U.S. involvement in wars in Kuwait and Iraq, the military invasion of Afghanistan and some of the most turbulent political winds in American history.

Hypothetical Illustration.

It’s helpful to remember that even if we feel unsettled about what’s going on in the world, bombs and missiles in the Middle East do not reduce the intrinsic value of U.S. stocks. Global conflict like this can be sad and frightening in the near term, but history suggest it’s probably not cause for concern in your portfolio.

Apella Capital, LLC, DBA Apella Wealth is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration with the SEC or any state securities authority does not imply a certain level of skill or training. Past performance does not guarantee future results. As with any investment strategy, there is the possibility of profitability as well as loss. Any chart that is presented in this material is for informational purposes only and should not be considered an all-inclusive formula for security selection.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non- investment related content made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may not be reflective of current opinions or positions.

Index Disclosure and Definitions All indexes have certain limitations. Investors cannot invest directly in an index. Indexes have no fees. Historical performance results for investment indexes generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance. Actual performance for client accounts may differ materially from the index portfolios.

MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries, with 1,465 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Related Articles