Apella Wealth Blog

Financial Wellness Check-Up

It’s time for a check-up! Don’t worry, this is not an article reminding you to have your annual physical, schedule a visit to your dentist, or complete a routine oil change (although, this article might serve a dual-purpose for those of you who haven’t). Rather, it’s an opportunity to be reflective, to take your financial temperature, and determine your financial state.

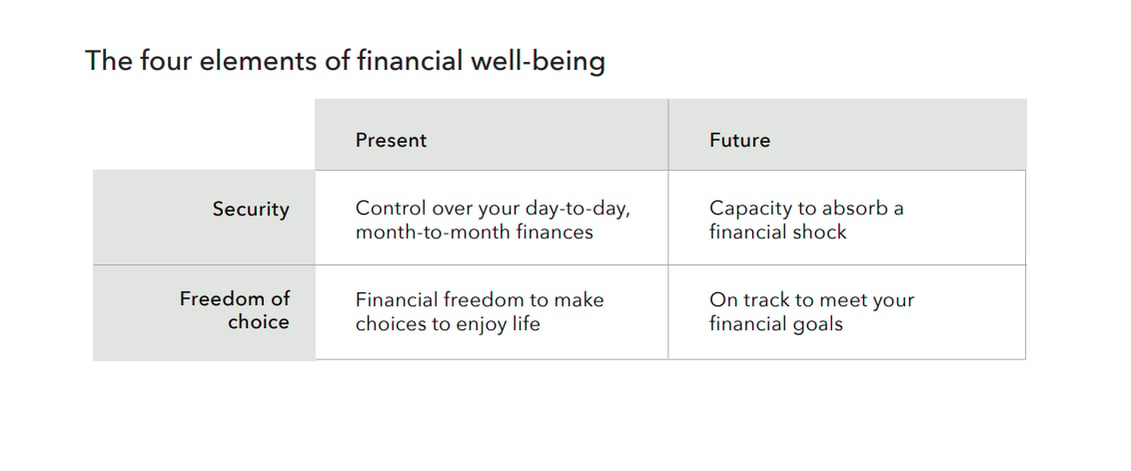

First things first, what is financial well-being? The Consumer Financial Protection Bureau states, “[financial] well-being is defined as having financial security and financial freedom of choice, in the present and in the future.”1 It is a highly personal and adaptive state influenced by circumstances both inside and outside of your control. According to the National Endowment for Financial Education (NEFE), “Financial Well-Being is an ever-changing, personal state that typically includes factors such as:

- satisfactorily managing one’s current financial situation

- the ability to exercise choice and feel in control of finances

- the outlook for future prospects.”2

In the same way that you have a different tolerance to heat, cold, and pain than your neighbor, your financial well-being is unique to you. In addition to being personal, financial well-being is a journey; It is not a one and done, I’m-good-for-the-year, type of thing. Rather, it is an ongoing, fluctuating state that requires intentional check-ups. As your financial planners, one of our primary roles is to “facilitate conversations about financial concerns, challenges, and goals that may influence or reflect financial well-being.”3 The heart of a financial well-being check-in is to determine how you think and feel about your financial situation.

See how these four elements of financial well-being are further illustrated below:4

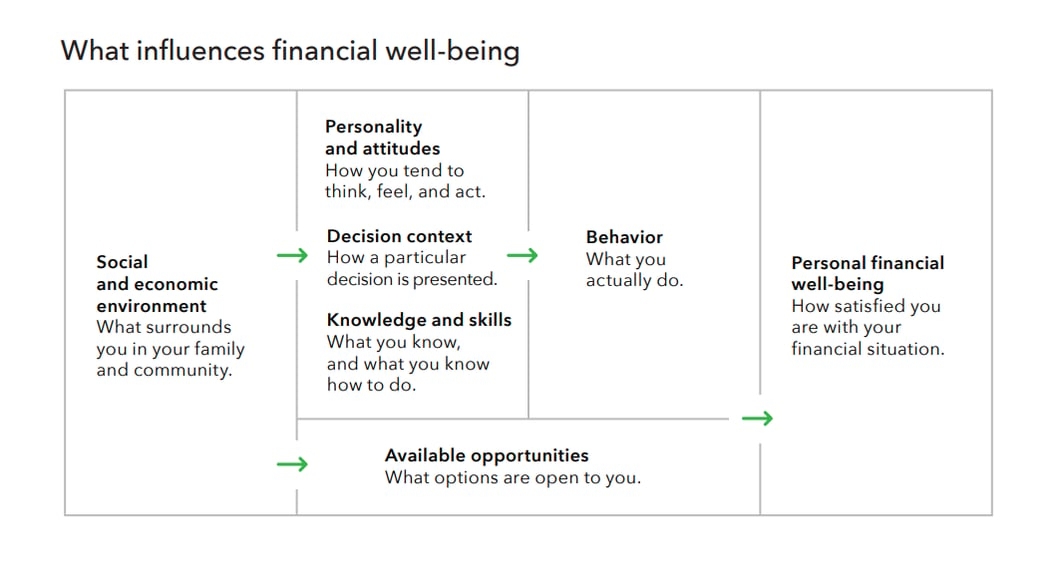

“There are multiple factors that affect an individual’s financial well-being, some of which are within a person’s control and some of which are not.”5 See the chart below which highlights the influencing factors on your day-to-day financial well-being.6

Now that you understand the personal nature of financial well-being and the components that influence it, how do you measure your current state? After significant research and data analysis, the Consumer Financial Protection Bureau (CFPB) has developed 10-questions related to security and freedom of choice that correspond to a scaled financial well-being score. If you are interested in learning your score, you can access the online quiz here.7

It is important to establish a baseline for your financial well-being, so you can more easily identify when you feel less than, average, or better than normal regarding your financial health. We take your financial well-being seriously and would love to continue the conversation with you. As your partner and financial planner, we commit to:

- Ask good questions, find facts, and apply them effectively to your financial plan

- Provide quality and clear financial information

- Identify and set realistic goals and create plans to achieve them

- Help develop sound habits to live within your means

- Encourage confidence and reinforce a sense of agency8

If this resonates with you, we invite you to reach out to your planner for a financial wellness check.

Sources:

1. Financial well-being: What it means and how it to help. Financial well-being: The goal of financial education | Consumer Financial Protection Bureau (consumerfinance.gov)2. Core Concept: Financial Well-Being | Personal Finance Ecosystem | NEFE

3. Integrate the Financial Well-being Scale into Your Program | Consumer Financial Protection Bureau (consumerfinance.gov)

4. Financial well-being: The goal of financial education | Consumer Financial Protection Bureau (consumerfinance.gov)

5. Financial well-being resources | Consumer Financial Protection Bureau (consumerfinance.gov)

6. Financial well-being: What it means and how to help. consumerfinance.gov/reports/financial-well-being

7. Find out your financial well-being | Consumer Financial Protection Bureau (consumerfinance.gov)

8. Financial Well-being: What it means and how to help. Consumerfinance.gov/reports/financial-well-being

Disclosures:

Apella Capital, LLC (“Apella”), DBA Apella Wealth is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered or excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Apella Wealth provides this communication as a matter of general information. Any data or statistics quoted are from sources believed to be reliable but cannot be guaranteed or warranted.

Related Articles

Ways to Safeguard Against Financial Exploitation for All Ages

Financial fraud can have devastating consequences for all ages, often leading to irreparable harm...Four Ways to Jumpstart Your Financial Plan for Success

✔ Consolidate investment accounts with a single trusted Financial Planner.Some investors believe in...