Gas, crude oil, propane and natural gas prices rising; food prices rising; inflation rising; businesses struggling to retain employees; a President with low approval ratings; war in the Ukraine; the prospect of war with Russia; did I mention inflation?

When you have the job of financial advisor or investment manager as long as I have, you’ve had these conversations hundreds of times…literally. “What should we do with our investments in this environment?” These events are all to be taken seriously and they affect each of us in many ways. But through it all and over the course of the last 70 years or so, stock markets have climbed steadily because at the end of the day, the thousands of companies that make up these markets grow over time in aggregate. Some will go out of business but others replace them and some grow exponentially. Markets are resilient and shake off geopolitical events in relatively short order.

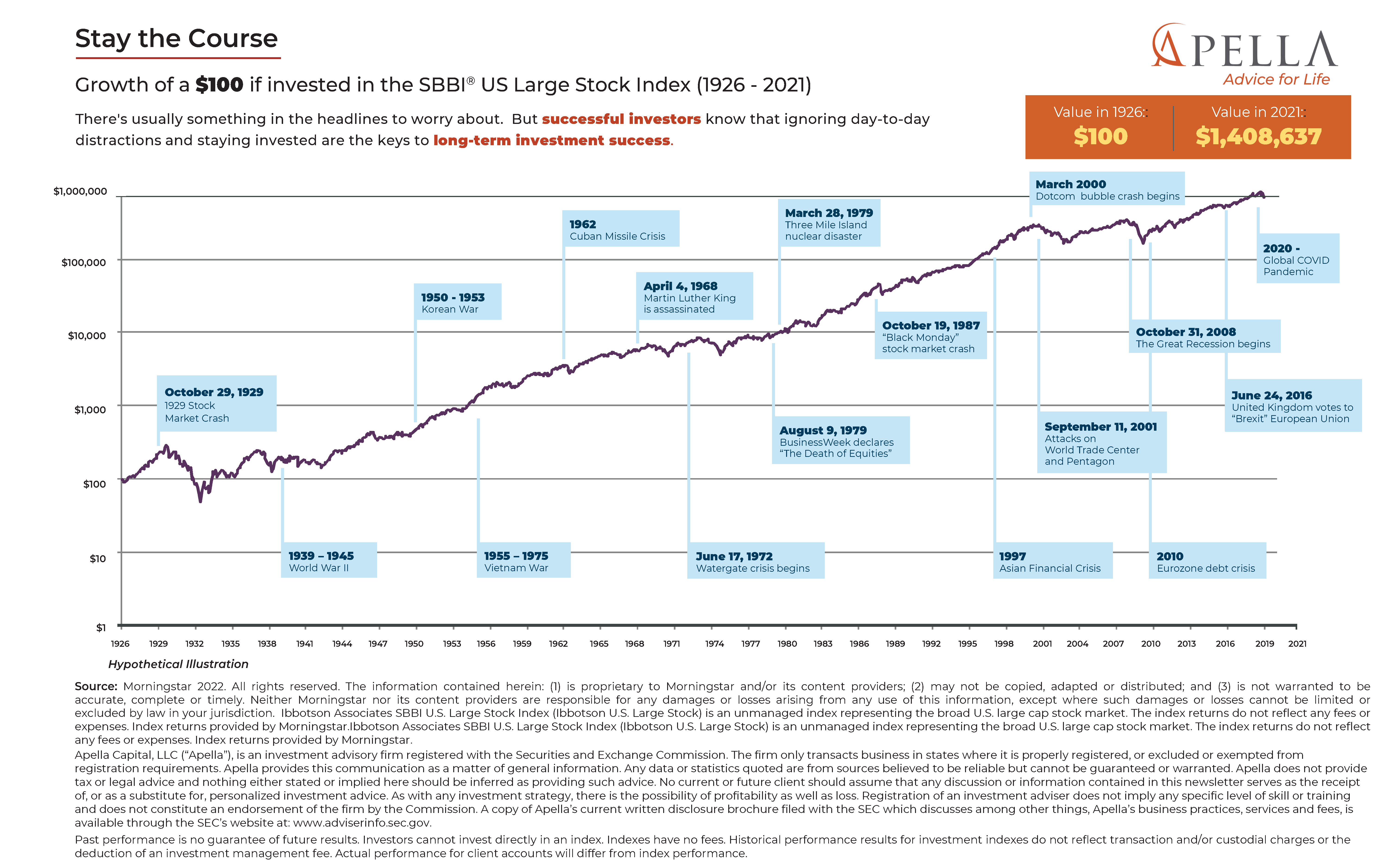

Events like these occur with some regularity yet the US stock market has returned on average between 9% and 10% annually for the past century1. See the chart below and understand that while you can always come up with a reason not to invest, it’s usually the wrong move provided you have an appropriate time horizon. We believe diversification and patience are the two most important aspects of an investment portfolio. If you have trouble sleeping at night because of world events, speak with your financial advisor.

- Knueven, Liz. “The Average Stock Market Return over the Past 10 Years.”Business Insider, Business Insider, 14 June 2021, https://www.businessinsider.com/personal-finance/average-stock-market-return.

Apella Capital, LLC is an investment advisory firm registered with the Securities and Exchange Commission. The firm only transacts business in states where it is properly registered or excluded or exempted from registration requirements. Registration with the SEC or any state securities authority does not imply any level of skill or training. No one should assume that future performance of any specific investment, investment strategy, product, or non-investment related content made reference to directly or indirectly in this material will be profitable. You should not assume any discussion or information contained in this email serves as the receipt of, or as a substitute for, personalized investment advice. As with any investment strategy, there is the possibility of profitability as well as loss. Apella Capital, LLC does not provide tax or legal advice and nothing either stated or implied here should be inferred as providing such advice. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Diversification seeks to reduce volatility by spreading your investment dollars into various asset classes to add balance to your portfolio. Using this methodology, however, does not guarantee a profit or protection from loss in a declining market.